REPUBLIKA.CO.ID, JAKARTA — Task Manager (Plt) Deputy Office of the Financial Services Authority (OJK) of West Sumatra Province (Sumbar) Irawati said the importance of increasing literacy and inclusion in driving the acceleration of Indonesia's sharia capital market. Irawati said the OJK periodically organizes the National Survey of Financial Literacy and Inclusion (SNLIK) to measure people's level of understanding and use of financial services products.

“In SNLIK 2024 for 2023 data, the Financial Literacy Index (ILK) was 65.43 percent and the Financial Inclusion Index (IIK) was 75.02 percent,” said Irawati during the Financial Merdeka 2024 event on Saturday (August 31, 2024).

Irawati detailed conventional ILK service types in 2023 at 65.08 percent and Islamic ILK in 2023 at 39.11 percent. Meanwhile, conventional IIK in 2023 amounted to 73.55 percent and Islamic IIK was 12.88 percent.

“So the literacy and financial inclusion of the sharia is still far below the conventional one. If we look specifically at ILK conventional capital market it is 15.32 percent, while ILK sharia capital market is only 5.48 percent,” Irawati said.

Irawati said that the Islamic capital market is much smaller at only 0.37 percent compared to the conventional capital market IIC, which is 1.60 percent. Irawati considers the capital market index an anomaly compared to other financial services sectors.

“In other financial services sectors, there are a lot of users but those who understand the numbers are smaller. In the capital markets, those who understand a lot, but who use much less. It becomes our common challenge to improve capital markets in society,” Irawati continued.

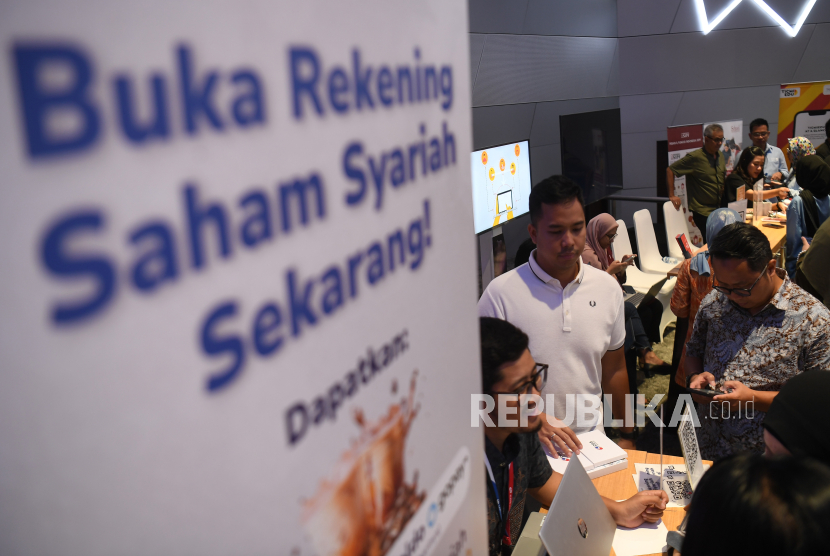

Irawati said the sharia capital market has great potential to continue growing. Irawati believes that the presence of technology provides a lot of ease in getting the younger generation to invest in the sharia capital market.

“Advances in technology make it easy for young people to be informed about financial management and investment,” said Irawati.

Irawati said the term Financial Independence is also one of the most discussed topics of Gen Z and millennials, who currently account for 49 percent of Sumbar's total population. Irawati considers literacy to be crucial in preventing the negative impact of technology in the financial services sector.

“With literacy, people will not be easily swayed by illegal investment offers, illegal gambling, and loss-making online gambling,” Irawati said.