REPUBLIKA.CO.ID, JAKARTA -- President Commissioner of PT Bank Syariah Indonesia Tbk or BSI, biggest and state-owned sharia bank in Indonesia, Muliaman D Hadad claims sharia banking industry in Indonesia maintain better performance than the conventional bank. Therefore, sharia banking can be a focus to grow amid global economic uncertainty and upcoming Indonesia's elections.

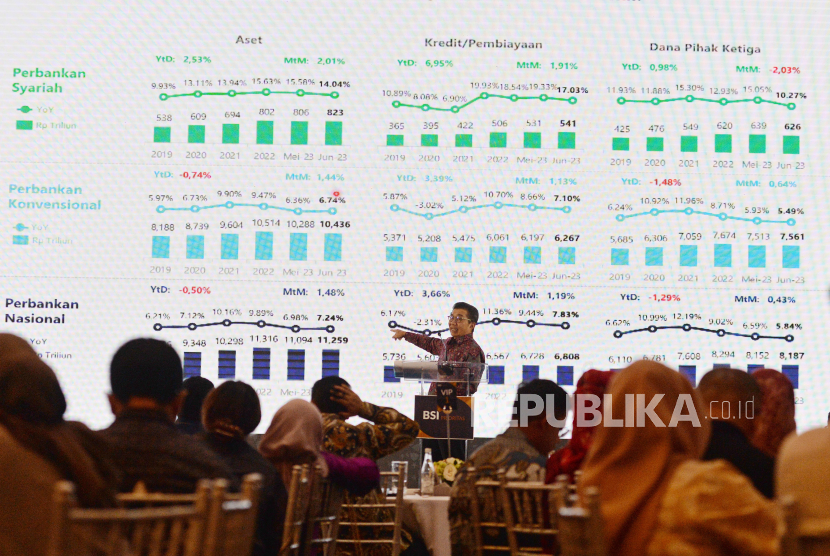

Muliaman said the development of sharia banking since 2019 has always been double digits, higher than conventional and national banking as a whole.

“So from this figure, I can say that the performance of sharia banks is better than the performance of conventional and national banking,” Muliaman said at the priority gathering of BSI Priority customers and market outlook 2024 titled Finding Silver Linings in A Year of Uncertainty at Hotel Langham, Jakarta, Wednesday (25/10/2023).

Muliaman said that growth in sharia banking assets up to June 2023 reached 14 percent or higher than conventional banking which was only 6.47 percent.

“I think this is very high compared to conventional banking which is only a half,” Muliaman said.

However, Muliaman said still there concerning point hindering for growth. The current issue of sharia banking (still) lies in the low market share, which is only about six percent to seven percent, after more than 30 years of sharia banking journey first established in 1992.

Moreover, Muliaman assert only ten out of 100 people who have sharia bank accounts. Such a low inclusion for one of the biggest Muslim country in the world.

“Our challenge is to encourage literacy as well as inclusion, which is why I always advise BSI that the stigma of sharia banks, which seems to be cumbersome and expensive, should be eliminated immediately,” Muliaman said.

Muliaman claims the service and cost are competitive now compared to conventional banking. This one big step hopefully make people believe and switch to using sharia banking.

Potential customers for industry are middle to upper society. So that he invited BSI's priority customers, whose own account of more than Rp 500 milion or USD 31.387, to join the tribe improving literacy and inclusion of sharia banking to the community as well.

“This will create an ever larger and larger ecosystem. This will accelerate the 6-7 percent figure that since I was in BI and the FSA that figure hasn't changed much. Hopefully this number can change soon with a smart approach,” Muliaman said.