They do not have any access to traditional bank loan, but Muhammad Yunus gives them a loan. He trusts them. His trust achieves his goal. The loan successfully lifts their economic condition.

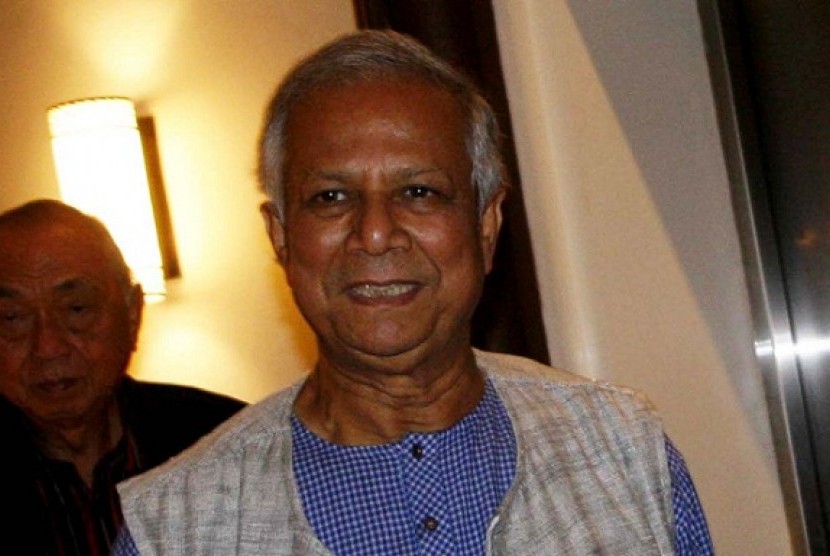

That is the work of Muhammad Yunus, a Bangladeshi banker and economist who develops micro credit concept and microfinance as a financing way for those who do not have access to traditional bank loan. With such achievement, he was awarded the 2006 Nobel Peace Prize. In its official page, Nobel writes that the awards presented to Muhammad Yunus and Grameen Bank "for their efforts to create economic and social development from below".

In International Microfinance Conference at Yogyakarya on October 22-23, Muhammad Yunus shared the tricks to make microfinance as a solution for people. He was a keynote speaker on the event held by the Indonesian Ministry of Cooperatives and Small Medium Enterprises (SMEs). The founder of Grameen Bank delivered a speech entitled 'Microfinance as a Social Business: A Way to Solve Society's Most Pressing Problems'.

In his opinion, social business activity is similar with or even more valuable than philanthropist because it can improve the rate of economic independence. He said that philanthropist gave money to people, but people who received it might not get the money back. Meanwhile, he said, social business gave money to people and people who received it could get the money back.

While opening the conference on Monday, President Susilo Bambang Yudhyono said that microfinance, micro credit, and inclusive finance were not the goal. "The goal is the decreasing of poverty and unemployment, the developing of micro medium cooperative, and also the decreasing of discrepancy," SBY said.

Minister of Cooperatives and SMEs Syarifuddin Hasan said the International Microfinance Conference was a tool to share information, ideas, and new knowledge to encourage innovation in microfinance industry.

"Government has successfully implemented microfinance through People Business Credit (KUR)," Hasan said.

Meanwhile, the Governor of Yogyakarta Sri Sultan Hamengku Buwono X said the scheme of microfinance was an effective way to help small medium enterprises accessing credit to develop their business.