REPUBLIKA.CO.ID, JAKARTA -- Sharia insurance plays an important role in managing financial risks, especially in protecting assets from the effects of health crises and unexpected financial conditions. Global data show that 43 million people will die from critical illness by 2023.

In Indonesia, cases of critical illness increased dramatically by 28 percent in just one year, from 23 million cases in 2022 to 29 million in 2023. Without proper protection, a person risks losing not only his health, but also financial stability and wealth assets.

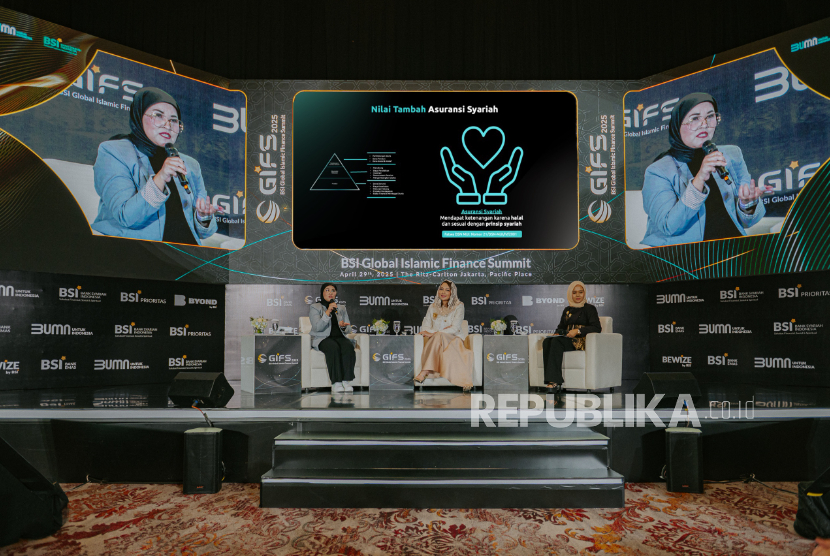

“We often feel safe because we have assets, but when a health emergency comes, those assets can't always be immediately disbursed. Insurance, including sharia-based insurance, plays a role in managing financial risks, such as financial risks for example,” explained Prudential Sharia Chief Customer & Marketing Officer Vivin Arbianti Gautama at the Global Islamic Finance Summit 2025 on Tuesday (29/4/2025).

Sharia insurance provides benefits when there is a risk of death, as well as a health risk.

In sharia insurance, there is a plus that is given to each customer, namely in the form of help between fellow participants. Each participant who pays for sharia insurance will contribute to helping other customers in the event of an accident.

“So, when a customer never makes a claim, he will still be counted on to contribute, making an impact on other customers,” Vivin said.

In addition, sharia insurance adheres to the principles of free usury, gharar, and maysir, participant funds are managed transparently and fairly in the spirit of gotong royong through the Tabarru' Fund. This principle is the strength of sharia insurance, in which participants contribute to help each other in the face of various life risks, so that protection is not only a manifestation of individual protection but also a form of social care for achieving prosperity in life.

The benefits of sharia insurance benefits do not only arise in the event of an accident. It is also part of long-term wealth planning strategies, such as preparing retirement funds, supporting children's education planning, to maintaining the availability of emergency funds without the need to sacrifice productive assets.

Benefit from insurance can also be an important source of liquidity to maintain the viability of a business and family or prepare a valuable relic for the family.

“Prevention is always better than cure, including in managing finances. With insurance, particularly sharia insurance, we protect ourselves from large unexpected losses, keep assets safe, and provide peace of mind for families,” Vivin said.