REPUBLIKA.CO.ID, JAKARTA - Freeport McMoRan Copper & Gold Inc has offered Indonesia a further 9.36 percent stake in its local subsidiary, which runs the world's second biggest copper mine, a move that appeared aimed at easing pressure over new mining rules. Such a stake could be worth more than 1 billion USD, although the company gave no estimates itself.

Indonesia's government, which already owns 9.36 percent of Freeport Indonesia as its only other shareholder, is pushing for a bigger slice of mining revenues through higher royalties and new regulations that require foreign miners to sell 51 percent of assets after 10 years of production. Those changes have shaken the industry in one of the world's top metals producers and an export tax and demand for more domestic refining affected copper shipments in June.

US -based Freeport, the world's biggest listed copper company, did not say on Tuesday why it had offered to sell a bigger stake in its Indonesia operations to the government. It said it was protected from the new rules on divestment by its long-term operating agreement. Indonesia will account for a about a quarter of Freeport's forecast copper production this year.

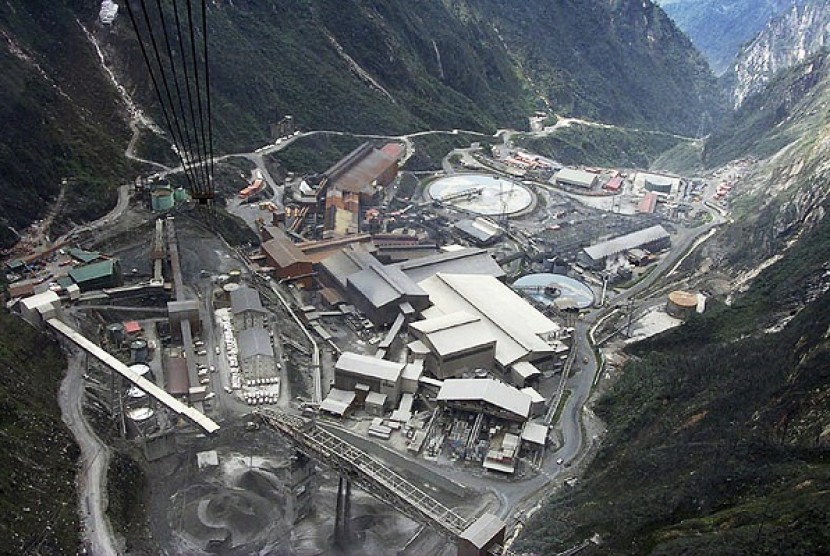

Freeport Indonesia spokesman Ramdani Sirait said the national government had offered the additional stake to the local administration in Papua province, home of its Grasberg mine, and that authorities there had shown interest. "However, Freeport McMoran also sees an initial public offering as an option for divesting the shares," he said.

Freeport has previously said it was considering a share offer in Jakarta without indicating its possible size. Lawyers say that may be a way for the company to manage the impact of the new foreign ownership rules, and would follow the path taken by Vale SA in listing a unit in Indonesia.

Hard to value

If not, it might have to follow US miner Newmont, which has already been forced to divest a majority stake. Any move by Freeport to sell a 9 percent stake would cut Freeport's share of revenues from one of the world's richest mines at a time it needs to invest billions to dig ore from deeper underground in its remote mountain project.

The value of its Indonesian unit was not immediately clear. Freeport, which has a market capitalisation of 32 billion USD, sold a 10 percent stake in its Indonesian operations to Indonesia's Bakrie Group for 212.5 million USD in January 1992, and then bought half of it back at the end of that year at almost the same price. Since then copper prices have soared.

According to local media, Freeport in 2009 offered a 9.36 percent stake to the Indonesian government for 1 billion USD, but no deal was reached. On a sales basis, Freeport Indonesia's output is forecast at 930 million pounds of copper this year, a quarter of the company's total forecast copper production this year. Its Indonesia mine also has the world's largest gold reserves and produces silver. The local government of Papua, where a separatist movement has long pushed for a greater share of resource revenues, may be unable to afford the stake, industry sources said.

Newmont ended up selling a stake to the central government and to local governments in a deal funded by the politically connected Bakrie Group. "The new policy primarily benefits politically influential conglomerates, especially the Bakrie Group," said Kevin O'Rourke, an independent Jakarta-based risk consultant.